Hey sweetie! If in 2025 you're tired of being broke, stressed, and overwhelmed, you've come to the right place. This articleis addressed to everyone: students, young (or less young) workers. Every situation is covered here.We will explore together how to get out of debt + create multiple income streams. If you are an heir, congratulations on being God's favorite, for the rest of y'all brookies, keep reading 😉 kisses

reduce your expenses

Conduct a personal finance audit

“What cannot be measured, cannot be improved” <= That's the very principle of continuous improvement. Want to get your finances in order? Than start off by facing them. This part is fundamental. Make an overview of you different bank accounts: this helps to identify your financial pitfalls: unused Netflix/Disney+ subscriptions, excessive Uber Eats deliveries, compulsive shopping...you name it.

Budget !

Once the inventory is finalized, you must establish a budget, and stick to it. The most difficult step here <=is discipline. If you are a student, say no to outings that drain your budget. If you are a profesional (with or without a family to support): prioritize. What is most important? Which expenses are essential (immediately, later)? Your priority is the family you have created. No money is sent outside of the household until all internal bills are paid (poke to Africans in the diaspora).

Find cheaper options

To have a budget, does not mean to say no to everything else. You still need to live happy and enjoy yourself. Consider the alternatives available to you. For services, compare and get competitive bids (health insurance, interne and phone subscription). When it comes to the purchase of products and/or services: check out the discounts offered by your works councils (partnerships for household appliances, vacation vouchers, etc.), discounts for large families, student discounts, visit the website groupon.fr for discounted outings, travel off-season if you can (train, plane, carpool).

Boost your income

Disclaimer

Warning: NEVER invest in something you don't fully understand! To invest means to be willing to lose money also. If you don't understand the topics you're investing your money in, for your own good and safety, don't do it. Also, avoid any illegal activities or incomes streams that will be hard to justify at family gatherings. You are probably too cute to go to jail fam’.

For students

Good financial habits start now. I previously wrote an article especially for you, explaining how to find a job that is compatible with your studies. Click this link to read it..

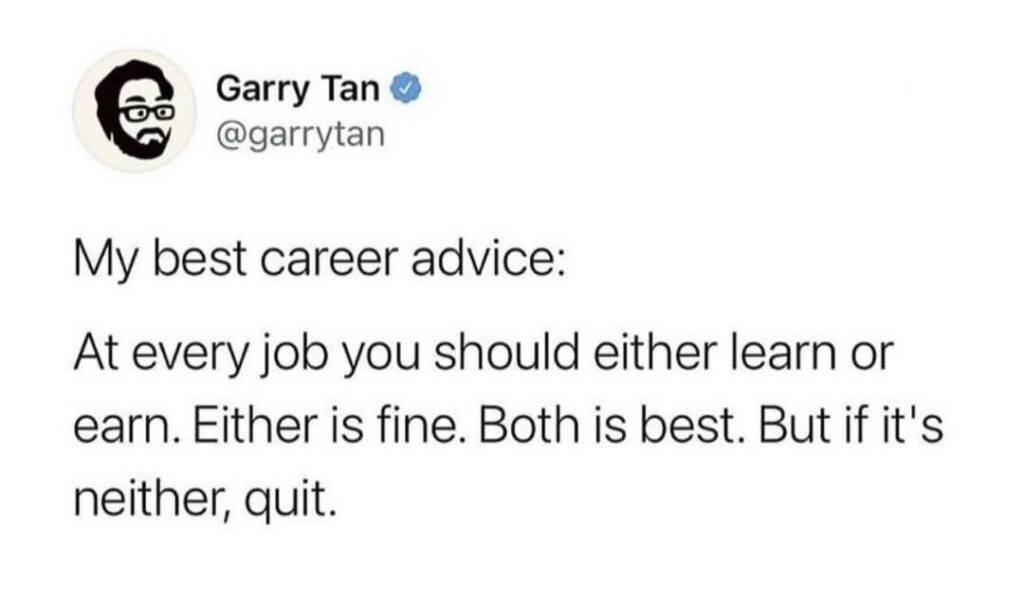

Negotiate or leave

You've been in your job for years. Your responsibilities are increasing, but your salary isn't? In BIG 2025, enough is enough. You have two choices: negotiate a raise or prepare to leave. There is a saying from where I come from, “this (job) is not your father's house”, so please don't be fooled with "we are one big family" and "we have a baby-foot in the break room". We want cash. Come prepared to your anual performance review because in order to negotiate you will need data that showcases your work (actual results). If you have the opportunity, you can also prepare your resume, go to interviews to test your profile on the market, and then return to the negotiating table with the offers you have received elsewhere.

Corporate sponsorship: professional referral

The principle is simple. The company you work for is looking to recruit and offers a referral bonus. You suggest one or more profiles (resume), and if the person is hired, you earn money. It's a win-win situation: the job seeker finds work, the company finds its jewell, and you earn a commission.

Wage savings plan: PEE, PERCO, PER, profit sharing

Not long ago, I found out about this program, I honestly wish I knew about it earlier. So, I am letting you know NOW. Follow this link service-public.fr that will explain better than I can what this is all about. If you are liable for tax (this applies to France), part of the payments is tax deductible. So check for the program details with your employer and make sure you follow the necessary steps within the deadlines.

Bank sponsorship

Some banks offer referral programs: if you bring in a new customer, they will pay you and your referral a certain amount: make sure you comply with the conditions (account opening + first minimum deposit). commercial break: If you are looking for a new bank, please go through my link BOURSOBANK sponsorship *wink*. I can confirm that there are no payment fees in South Korea! Follow this link to read the article regarding my trip to South Korea.

Wage Carriage and freelance work

Once again, check the followingdetailed explanation of wage carriage on the service-public.fr website. This option allows you to increase your income and gain flexibility in your time. Unlike freelance work, this alternative does not require you to create business in your name. The "porting company" handles all the administrative aspects for you (drafting contracts, invoices, employer and taxes declarations, etc). Warning: depending on your field of activity and your experience/seniority in the field, find out about employability and current rates from pleople with a similar situation.

Some ressources

Adopt a wealthy mindset by follow accounts that talk about money. Wether you try to get out of a persistent debt, or if you're more interested in building wealth, be curious and educate yourself. Some of my favorites on Youtube Nischa (Investment Banker), Patricia Bright (real estate, fashion), The Ramsey Show (financial advice for individuals in debt), this video from Tika Ghafar, where she explains how she saved $50,000 before quitting her job. On Instagram: Maureen Ayite (Nanawax fashion, luxury real estate). Podcast: Richissime de Delphine Pinon. Take the best and leave the rest.

Final words

There may be many reasons why you want to increase your income. Whether it's to prepare for a real estate investment, trying for a baby (babies are expensive!), your next vacation to Dubai, or simply to reduce your anxiety towards money, the above options will help you prepare as best as possible. This will require you to a genuine willingness and discipline. No magic formula! Only practical and easy-to-implement advice. So take your finances seriously and reduce your stress.

XO, Mama

What about you? What practical advice can you share with our readers? Leave us a comment below !

Hey ppssssttt ! Did you like this article? There are lots more! Check them out and leave me a comment!

Excellent !

C’est vrai que tout est une question de discipline !

Merci des conseils 👌🏾

Effectivement ! La clé de tous les projets=> discipline.

Merci pour ton commentaire

Très instructif. Merci beaucoup 🙏🏾

Je prends pour moi-même, et je passe aussi le lien à ma fille.

Bonjour Mireille, je vous remercie pour votre commentaire. Partagez à volonté 🤝🏾

Merci pour cet article intéressant avec des liens utiles!

Bonjour, je te remercie pour ton retour. N’hésites pas à lire les autres articles et les partager !

Merci @chillingwithmama pour les pistes et conseils. 🙏🙏

Avec plaisir ! Et merci pour ton retour, c’est très apprécié

Merci pour ces conseils ! Le podcast « Histoires d’argent » de Fab Florent est aussi intéressant pour comprendre nos liens à l’argent.

Merci pour ton commentaire et pour la recommandation !

Contenu super utile et pratique. Merci pour tous ces conseils encourageants!

Ravie que l’article t’ait plu ! N’hésite pas à la partager 😉